Macy’s out of focus- Attempting to stop the bleeding through massive cost cutting while trying to … [+]

Macy’s

Recently, I decided to get a feel for their progress by visited my neighboring Macy’s in suburban Minneapolis’s Ridgedale Mall, after a nine-month absence. Given the store’s complete 2014 renovation I did not expect it to be on the closure list, and it was not.

Like every other COVID- compliant retailer, I saw the proper signage, the ever-present plexiglass shields, and a bit more circulation area. In response to their new BOPIS focus, a newly installed service center and pick-up counter was placed near an entry. This addition seemed popular, based on the long cueing line; not to mention a slightly overwhelmed sole-attendant.

Vacant sales counters, confusing messaging, and lack of sales associates undermine Macy’s attempt to … [+]

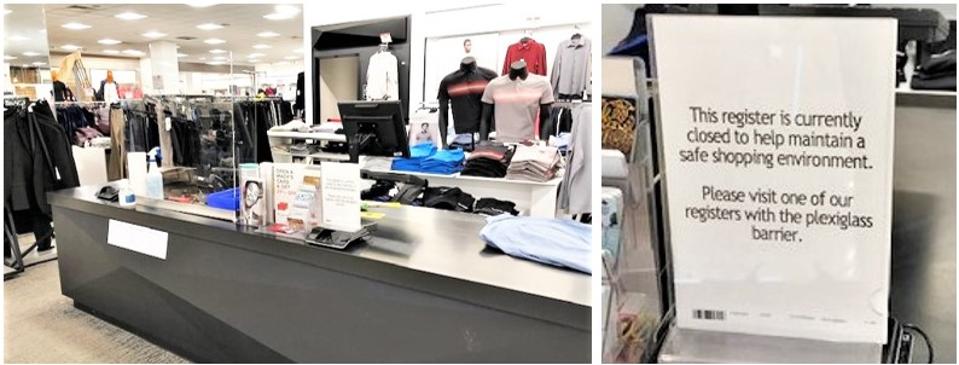

While conducting my ad hoc visual audit, it appeared that some legacy issues remained. There were numerous unattended department POS counters, with signs reading “this register is currently closed to help maintain a safe shopping environment. Please visit one of our registers with the plexiglass barrier” (which that counter had). A passing couple with an arm full of goods pondered out loud “ok, now all we have to do is find someone to take our money.” A personal déjà vu experience.

Who’s the Boss

Regrettably, Macy’s has succumbed to a sad dichotomy playing out across the category. Struggling retailers are too often forced to stop the bleeding through cost cutting, while at the same time needing to improve the sub-par value proposition, which got them in trouble in the first place. These are not readily achievable twin-goals.

When Macy’s Polaris strategy was first announced it boasted three components: an enhanced e-commerce site, a new smaller-sized store format, and a focus on its best stores located in “high caliber” shopping malls. Not surprisingly, “superior customer service” was not a stated priority. These initiatives went hand in hand with massive cuts that were expected to generate $1.5 billion by the end of 2022. The cuts included “adjusting its staffing with reductions in some stores and increases in others.”

I can vividly remember shopping the same mall, at Macy’s predecessor’s store (two-times removed), Minnesota’s much beloved Dayton’s. They also happen to be the parent of Target

Retail Blocking and Tackling

My Forbes.com colleague, Steven Dennis in a recent article noted “Very few brick-and-mortar dominant brands that have a remarkable value proposition, well executed against a clearly identified set of target customers are closing stores, even in the COVID-19 economy.” And while Macy’s is attempting to shrink its way back to viability or relevance, they might consider hiring more people to take money. Seems like a solid investment.

Ironically, the companies who have consistently created success through attaining a great value proposition – Target, Best Buy

Mauled Under

What was once Macy’s advantage has now become a liability. Too many of their stores are in mall’s whose “sell-by” dates have passed. And their most recent batch of 36 announced 2021 closures, reveal a wide swath of affected mall owners, including four of the five largest REIT’s. Those vulnerabilities were the subject of S&P Global Market Intelligence Report, that I recently commented on.

They include three stores in Simon Property Group

S&P Global report revealed at the end of 2019, 31 Macy’s stores anchored CBL-owned properties, of which Macy’s owns 20 of the stores totaling 4.5 million square feet. However, that pales in comparison to the Simon Property Group stake, with 113 U.S. Macy’s mall and outlet store leases totaling 21.7 million square feet. I would argue however that the CBL properties are in far greater jeopardy than the Simon malls, which are primarily higher-class A, A-, and B+ properties. The remaining store closures are distributed across a wide number of smaller property owners and investment groups.

The “small format” off mall store, successfully being undertaken by Nordstrom and Target, is now … [+]

Smaller Formats

One of the major undertakings of Story founder Rachel Shechtman, during her time at Macy’s involved the development of the new off mall concept Market by Macy’s. The second such unit recently opened in a lifestyle shopping center in Fort Worth, TX. The 20,000 square foot format has been characterized by Macy’s as having “a curated assortment of the best of Macy’s branded fashion within an easy-to-shop and open environment.” Sounds innocuous enough.

The PR further stated: “Market by Macy’s offers men’s, women, kids, beauty, home and giftables at accessible prices.” It also feature is a “Trend Pavilion” boasting a “constant flow of fashionable trends, must-haves and new merchandise throughout the season.” Last February, when the Market by Macy’s was first introduced, Rachel Shechtman described the concept as “a community-driven destination for customers to shop, eat, drink, learn, relax, catch up with friends and so much more.” Macy’s – where (or what) art thou?

More Stories

What Is the Difference Between Body Lotion & Body Cream?

How to Spot the Warning Signs of Teacher Sexual Misconduct

The Most Popular Engagement Ring Styles for Beach Lovers